Raising capital plays an important part in growing your organization into a successful venture. It...

Why is Raising Capital Much Harder in 2023?

The private capital markets are facing challenging times, particularly when it comes to the decline of Initial Public Offerings (IPOs). For several years, the number of IPOs has been dwindling, which is having a ripple effect across the entire investment landscape.

According to Statista there were 480 IPOs in 2020, 1,035 in 2021, and only 181 in 2022. There have only been 34 IPOs in Q1 of 2023, setting a pace for one the smallest number of IPOs since 2009.

IPOs have historically been an attractive exit strategy for private equity and venture capital firms. The ability to take a company public and sell shares to the public at a premium is often the culmination of years of hard work and investment. But in recent years, the number of IPOs has declined significantly.

This decline in IPOs has had a significant impact on private equity and venture capital firms. Without the ability to exit through an IPO, these firms are forced to look for alternative exit strategies, such as selling to strategic buyers or merging with another company. While these strategies can be successful, they often result in lower returns than an IPO would.

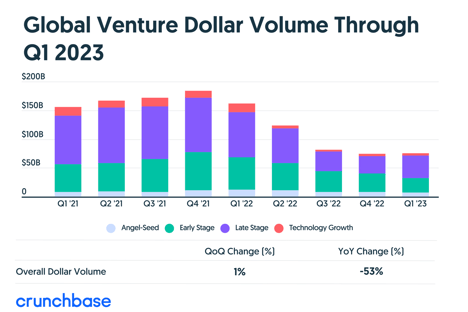

The impact of the decline in IPOs is felt all the way down to early stage investing. The first quarter of 2023 showed the slowest quarter for capital raised and deal count since 2017. With fewer opportunities for exit, early-stage investors are hesitant to invest in companies that may not have a clear path to liquidity. This means that early-stage companies may struggle to raise funding, which can limit their growth potential. In a recent report from Carta, total venture capital raised by startups plunged 80% from Q1 2022 to Q12023.

In looking at the chart from Crunchbase, venture investing has sharply declined since its peak in Q4 of 2021, but it does seem to plateau when comparing Q1 2023 to Q4 2022, giving hope that the bottom has been reached.

Another factor contributing to the decline in IPOs is the rise of alternative forms of funding, such as crowdfunding and direct listings. While these alternatives can provide companies with access to capital, they do not offer the same level of liquidity as an IPO.

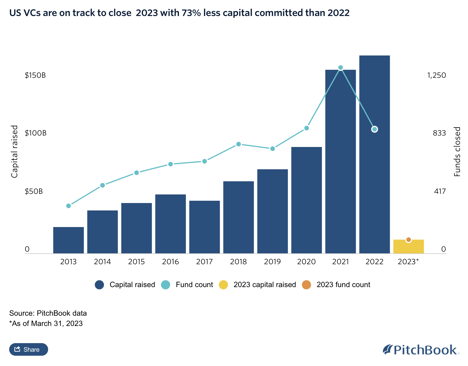

The result from declining IPOs has impacted the ability to raise capital for both private companies and funds that everyone is feeling now in 2023. Venture funds are off to a very slow start to the year, meaning there are less options for early-stage companies to find capital sources. Based upon information from Pitchbook, US based VCs are on track to close 2023 with 73% less capital committed than in 2022. We are on pace for levels we haven’t seen since the Great Recession.

So, what does this mean for anyone raising capital today? It means that you need to stand out from the crowd and be ready in advance for diligence and the questions that will come from investors. Any reason for an investor to say no will be taken, so be prepared in advance. The days of sending a pitch deck and a few meetings to raise capital are in the past. Organization, presentation, and an institutional level data room are critical to success as investors are seeing a lot of deals and are diving deep into due diligence.

In conclusion, the decline in IPOs is having a significant impact on the private capital markets. Without the ability to exit through an IPO, private equity and venture capital firms are forced to look for alternative exit strategies, which can result in lower returns. This is felt all the way down to early stage investing, where companies may struggle to raise funding without a clear path to liquidity. Those raising capital in 2023 need to be better prepared than in the past. The use of technology solutions, such as the Trellis Platform, are helping those raising capital to stand out from the crowd.